How to Invest in Web3: Key Strategies and Best Crypto Projects for New Investors

How to Invest in Web3

The rapid evolution of the internet has ushered in a new era known as Web3, transforming how people interact with digital platforms, data, and money. As this new internet paradigm takes shape, many investors are eager to learn how to invest in Web3 effectively, especially beginners who want to capitalize on the tremendous opportunities in this space.

This article will guide you through the fundamentals of Web3 investing, introduce top Web3 crypto projects.

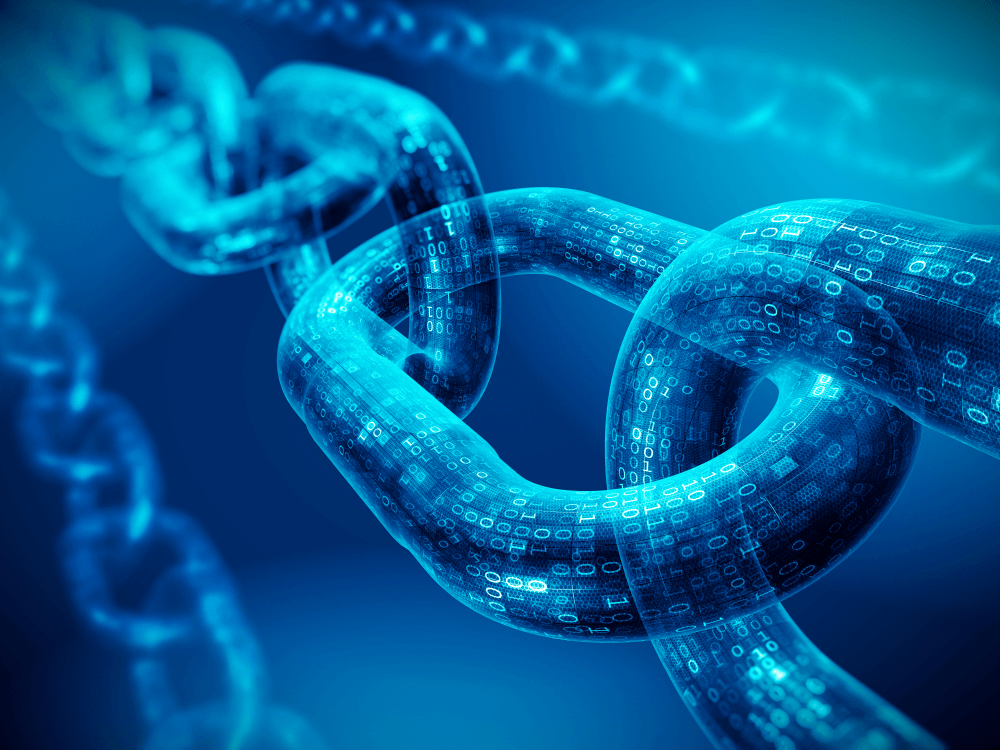

What is Web3?

Before you dive into the way of investing in web3, it is important to understand what web3 really is. Web3 refers to the third generation of the Internet, based on decentralized technologies such as blockchain, smart contract and Peer-to-peer network. Unlike Web2, which depends on centralized servers and companies, web3 emphasizes ownership, privacy and openness to the user.

Key features of Web3 include:

Decentralization: No single entity controls the network.

Trustless Transactions: Smart contracts automate transactions without intermediaries.

Tokenization: Assets and services can be tokenized and traded.

Interoperability: Different platforms and applications work seamlessly together.

Why Invest in Web3?

Understanding how to invest in Web3 begins with recognizing why this sector holds enormous potential:

Early Adoption Advantage: Web3 is still in its infancy, allowing early investors to gain significant benefits.

Innovation-Driven Growth: New technologies and use cases emerge rapidly, creating multiple growth avenues.

Financial Inclusion: Web3 offers access to financial services for unbanked populations worldwide.

User Empowerment: Users can control their data and digital identities.

Potential for High Returns: Many Web3 projects have shown exponential growth in token value.

How to Invest in Web3? A Beginner’s Guide

If you are wondering how to invest in Web3 as a beginner, here are step-by-step guidelines to get you started safely and effectively:

Educate Yourself

Understanding the core concepts of blockchain, decentralized finance (DeFi), NFTs, and smart contracts is essential. Numerous free resources, online courses, and community forums can help you build foundational knowledge.

Set Up a Crypto Wallet

A crypto wallet is your gateway to interacting with Web3 applications. Choose between:

Hot Wallets: Software wallets connected to the internet (e.g., MetaMask, Trust Wallet).

Cold Wallets: Hardware wallets for offline storage (e.g., Ledger, Trezor).

Choose a Reliable Exchange

To buy tokens or cryptocurrencies tied to Web3 projects, register on reputable crypto exchanges like Binance, Coinbase, or Kraken. Ensure the exchange supports the tokens you want to buy.

Research Projects Thoroughly

Not all Web3 projects are created equal. Look into project whitepapers, team backgrounds, partnerships, community engagement, and roadmap. Avoid hype-driven decisions.

Start Small and Diversify

Begin with a modest investment amount and diversify across multiple projects to reduce risk. Web3 is volatile, so balance is key.

Use Decentralized Platforms

Explore decentralized exchanges (DEXs) such as Uniswap or Pancake Swap, which often list new Web3 tokens earlier than centralized platforms.

Engage with the Community

Join Discord, Telegram groups, or Reddit forums related to your chosen projects. Staying informed will help you spot opportunities and risks early.

Keep Security in Mind

Use two-factor authentication, backup your seed phrases securely, and beware of phishing scams.

Top Web3 Crypto Projects for Beginners

To assist you in understanding how to invest in Web3, here are some top Web3 crypto projects suitable for beginners based on their innovation, community, and growth potential:

Ethereum (ETH)

Why: Ethereum is the foundation of Web3, powering most decentralized applications (dApps) and smart contracts.

Benefits: Strong developer community, continuous upgrades (Ethereum 2.0), and broad adoption.

Investment potential: As the leading smart contract platform, ETH’s value is likely to grow with Web3 expansion.

Polkadot (DOT)

Why: Polkadot enables interoperability between different blockchains, facilitating seamless communication.

Benefits: Innovative parachain technology, scalability, and strong ecosystem.

Investment potential: Polkadot’s unique approach to multi-chain networking positions it as a key Web3 infrastructure player.

Chainlink (LINK)

Why: Chainlink provides decentralized oracles that connect smart contracts with real-world data.

Benefits: Crucial for DeFi and Web3 apps needing reliable external data.

Investment potential: As Web3 projects increase, demand for secure oracles grows, benefiting LINK holders.

Filecoin (FIL)

Why: Filecoin offers decentralized storage solutions, a vital component of Web3 infrastructure.

Benefits: Cost-effective, secure storage, with rising adoption.

Investment potential: The need for decentralized data storage will rise, boosting FIL demand.

The Graph (GRT)

Why: The Graph indexes blockchain data, enabling easy querying for developers.

Benefits: Essential tool for building dApps with fast data retrieval.

Investment potential: Increasing dApp growth fuels demand for The Graph’s services.

Decentraland (MANA)

Why: Decentraland is a virtual reality platform built on Ethereum where users buy, sell, and build on virtual land.

Benefits: Popular metaverse project with growing user base.

Investment potential: Metaverse interest could drive MANA value significantly.

Aave (AAVE)

Why: Aave is a decentralized lending and borrowing platform.

Benefits: Leader in DeFi lending with strong user trust.

Investment potential: DeFi’s growth underpins Ave's long-term prospects.

Benefits of Investing in Web3 in the Future

When you explore how to invest in Web3, understanding the long-term benefits is just as important as knowing how to get started. Here are the key advantages that make Web3 investing promising:

Decentralized Ownership

Investing in Web3 means supporting technologies that return control to users, reducing dependency on centralized authorities and increasing transparency.

Financial Inclusion

Web3 breaks down barriers by enabling anyone with internet access to participate in financial systems, regardless of geography or economic status.

Innovation in Digital Assets

Web3 introduces new asset types like NFTs, tokenized real estate, and decentralized autonomous organizations (DAOs), creating novel investment and ownership models.

High Growth Potential

Many Web3 projects are still in early development stages, giving investors potential for outsized returns as these platforms mature.

Interoperability and Network Effects

Web3 projects often collaborate and integrate, building networks of value that enhance the utility and demand of their tokens.

Better Privacy and Security

Web3 leverages cryptographic technologies, which enhance user privacy and reduce vulnerabilities inherent in centralized systems.

Passive Income Opportunities

Through staking, yield farming, and liquidity provision, investors can earn passive income while supporting Web3 ecosystems.

Conclusion

Learning how to invest in Web3 opens a door to the future of the internet—a decentralized, user-centric digital world with transformative financial and social possibilities. Starting with foundational knowledge, choosing trustworthy crypto wallets and exchanges, researching top projects like Ethereum, Polkadot, and Chainlink, and understanding the long-term benefits will put you on the path to success.

As Web3 continues to evolve, investing wisely today can lead to substantial rewards in the years to come.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0