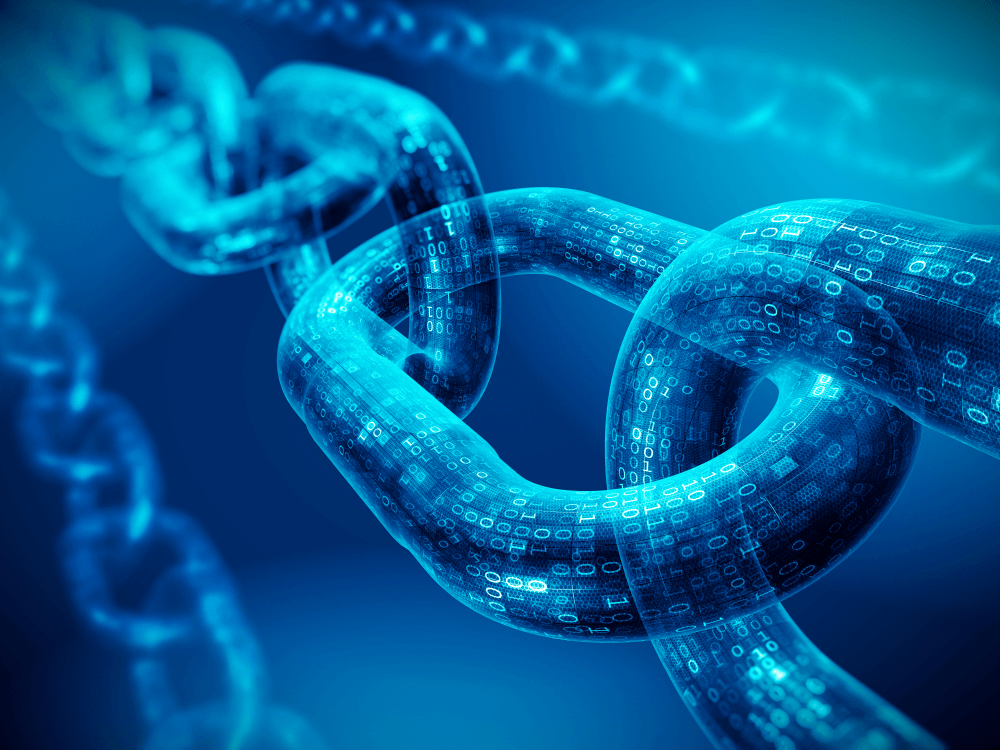

OTC Crypto Exchange Development: Myths vs Facts You Must Know

A practical guide to OTC crypto exchange development for institutional traders and large-volume transactions.

When it comes to the crypto world, one area that often gets misunderstood is OTC crypto exchange development. Unlike regular centralized exchanges, where trades happen on open order books, OTC (Over-the-Counter) platforms focus on high-volume, direct trades between parties, making them a preferred choice for institutional investors, high-net-worth individuals, and even blockchain projects looking to move large sums of crypto without affecting market prices.

Even with the rise in popularity, myths and misconceptions envelop OTC crypto exchanges and can confuse founders, traders, and even developers. Believing these myths may result in poor product decisions, compliance failures, or even financial losses.

In this article, we’ll debunk seven common myths about OTC crypto exchange development and reveal the facts you need to know before diving into this fast-growing segment of the crypto market.

Myth 1: OTC Crypto Exchanges are Just Like Regular Exchanges

Many founders assume that building an OTC crypto exchange is equivalent to launching a traditional centralized exchange, such as Binance or Coinbase.

Fact: The architecture and purpose of OTC exchanges are completely different.

During normal trading, matches are automatically executed as an order book, and prices vary according to market demand. On the other hand, OTC exchanges revolve around customised and negotiated transactions between buyers and sellers.

This means the backend must support:

- Real-time deal management with custom pricing

- Advanced settlement systems for multi-party transactions

- High liquidity pooling for bulk trades

- Escrow services to secure both sides of the deal

Building an OTC exchange without this specialized infrastructure is like trying to run a private bank on a regular retail banking app; it simply won’t work.

Myth 2: OTC Exchanges Don’t Need Liquidity

A dangerous misconception is that OTC exchanges don’t require liquidity because trades happen directly between parties.

Fact: Liquidity is still critical for a successful OTC platform.

Even though trades are private, the platform must be able to facilitate quick settlements. This often means working with:

- Multiple liquidity providers, including institutional market makers

- Smart routing algorithms that identify the best deal across networks

- Integration with cold and hot wallets for fast crypto movement

Without proper liquidity planning, your platform will face delays, failed deals, and loss of trust, which can destroy your reputation in a competitive market.

Myth 3: OTC Platforms are Completely Anonymous

One of the most significant attractions of OTC trading is privacy, yet some are convinced that these locations are a regulated and anonymous world.

Fact: Regulatory compliance is non-negotiable.

Governments across the globe have increased regulation of KYC (Know Your Customer) and AML (Anti-Money laundering) to avoid illegal activities. Even OTC desks have to introduce identity verification, transaction monitoring, and reporting systems.

Failure to comply can result in heavy fines, loss of operating licenses, and damage to investor trust. In certain jurisdictions, OTC exchanges also need to be registered as money service businesses (MSBs) or other similar entities.

Myth 4: OTC Crypto Exchange Development is Quick and Easy

Some entrepreneurs underestimate the complexity of building an OTC exchange, believing a basic crypto wallet and matching engine are enough.

Fact: OTC exchange development is highly complex and requires specialized expertise.

A successful OTC platform needs:

- Robust security infrastructure with multi-signature wallets and cold storage

- Automated escrow systems to prevent fraud

- Integration with fiat gateways for hybrid crypto-fiat deals

- AI-driven risk analysis tools to detect suspicious activity

- Customizable dashboards for institutional clients

The risks of frequent outages, hacking, and regulations can be very high when trying to launch with a simple tech stack, particularly when dealing with high amounts of crypto.

Myth 5: OTC Platforms Don’t Need Market Insights

Some founders assume that because OTC trades are private, there’s no need to track or analyze market data.

Fact: Analytics are essential for sustainable growth.

A well-designed OTC platform should include advanced analytics tools for:

- Tracking liquidity patterns and trade volumes

- Understanding client behavior and preferences

- Optimizing deal matching algorithms

- Reporting real-time compliance metrics

Without data-driven insights, it’s impossible to scale operations or attract institutional clients, who demand transparency and measurable performance.

Myth 6: OTC Exchange Development Costs are Always Sky-High

Cost is often seen as a barrier, with many assuming that developing an OTC exchange is prohibitively expensive.

Fact: Costs vary widely depending on development strategy.

While building from scratch can be expensive, businesses can cut costs by choosing white-label OTC exchange solutions. These pre-built frameworks come with:

- Core trading infrastructure

- Built-in compliance features

- Customizable branding and UI

- Faster time-to-market

White-label solutions allow startups to focus on growth and compliance rather than reinventing the wheel, while still maintaining high security and performance standards.

Final Thoughts

The OTC crypto exchange market is quickly developing, and myths and misconceptions may drive business in the wrong direction. Knowing the facts of OTC development will allow you to make smarter decisions, steer clear of compliance pitfalls, and create a platform that really satisfies the needs of high-volume traders and institutional clients.

If you’re exploring opportunities in this space, remember: success isn’t just about technology; it’s about strategy, trust, and adaptability.

By separating myths from facts, you’ll be better equipped to create a future-ready OTC crypto exchange that stands out in a crowded market.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0